Introduction

A Demat account is an account that is used to hold investments in an electronic format. It is very important to how to open demat account if you want to invest in shares, bonds, and other securities. The process of Dematerialization helps in converting the physical securities into electronic form so that they can be easily traded on the stock exchanges.

There are many benefits of having a Demat account such as it helps in saving time, and paperwork is reduced, and it is more convenient to trade.

If you are looking to open a Demat account in India, then you must know that any resident Indian can open a Demat account with a Depository Participant (DP). You will need to submit certain documents like identity proof and address proof for opening a Demat account. The process of opening a Demat account has now become very simple and can be done online as well as offline.

In conclusion, it is advisable to have a Demat account if you want to invest in shares and other securities. It is very easy to open a Demat account in India and the process has been made very simple by the depository participants.

What is a Demat account?

Types of Demat accounts

A Demat account is an account that is used to hold investments in an electronic format. It is very similar to a bank account, but instead of holding money, it holds shares, bonds, and other securities.

Types of Demat accounts

1) Individual Demat account: This type of account can be opened by a single person who will be the sole owner of the account and all the transactions will be carried out by this person only.

2) Joint Demat account: As the name suggests Brokerage Charges, this type of account can be opened by two or more people. All the holders will have equal rights over the securities held in the account and anyone holder can carry out transactions on behalf of all the holders.

Most people choose to open a joint Demat account because it gives them the flexibility to carry out transactions without having to depend on anyone else. It also comes in handy in case the primary holder is not available or is unable to transact for some reason.

Can I get personalized advice on yarn selection at a yarn store?

October 26, 2023

Comments are closed.

-

4 Simple Tricks To Find The Perfect Hair Salon

July 31, 2021 -

Is It Safe To Go To The Spa After Covid?

September 18, 2021 -

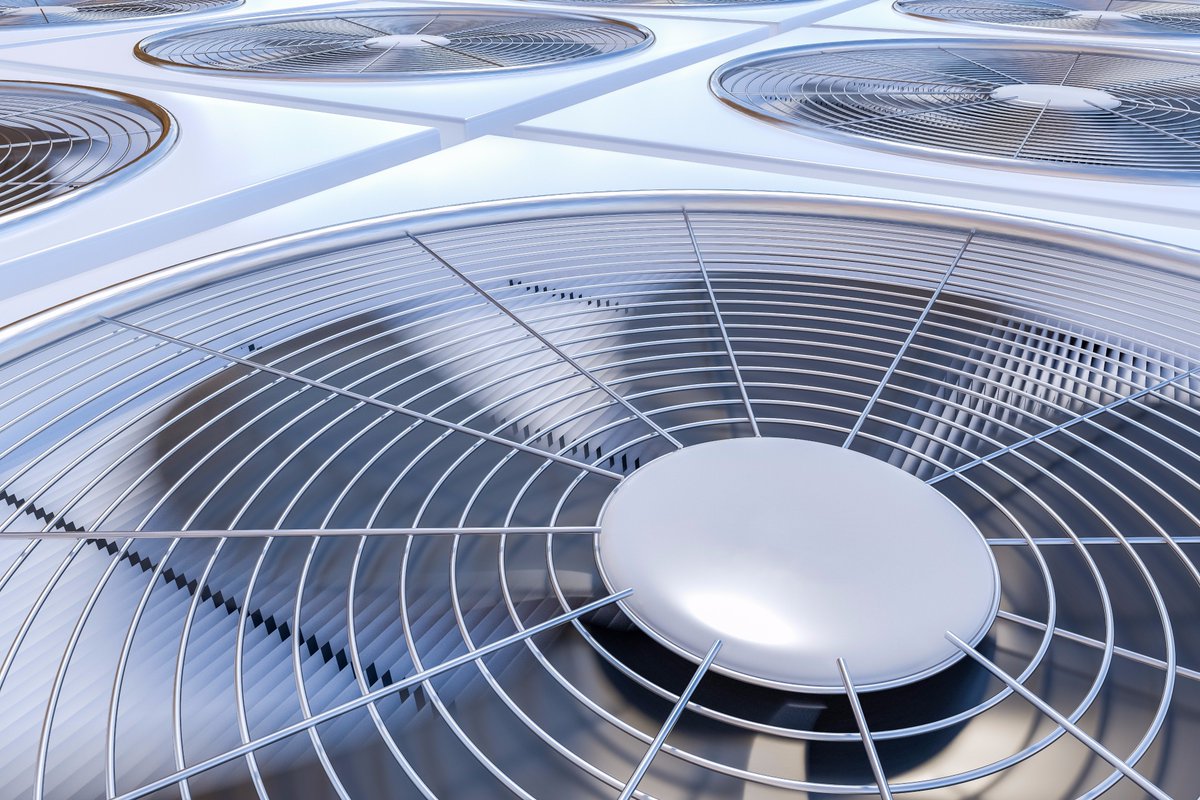

The Best Fan To Combat Heat

July 25, 2021